Chase offers two of the OUR FAVORITE credit cards with NO ANNUAL FEE and they don’t take a 5/24 spot!

If you have $6,000 of upcoming expenses in the next 3 months then applying for one of these cards is a great way to replenish your stash of Chase points. Think auto insurance, groceries, health care, travel, dining out, sports fees, educational expenses… life is expensive… you might as well earn some FREE travel along the way!

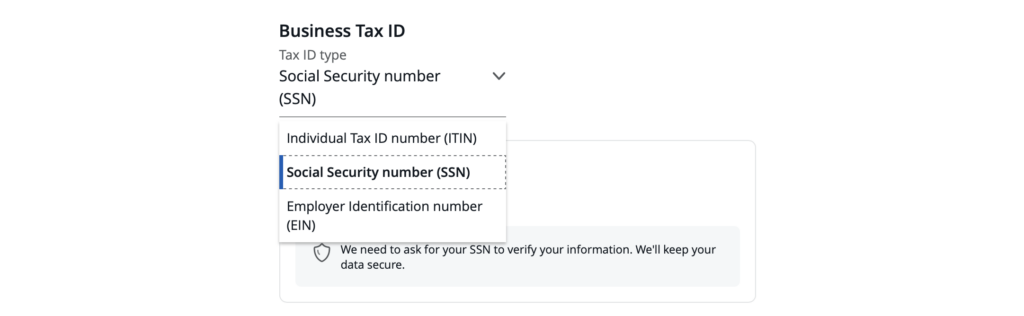

Both of these cards are business cards; HOWEVER, any sort of side income can qualify you to open a business card – even just selling some of your old stuff second-hand. No EIN necessary! You can apply with your SSN as a sole proprietor!

Other small business ideas:

- Tutoring

- Uber or DoorDash driver

- Photography

- Babysitting

- Rental properties

- Teaching music

- Landscaping

- Blogger

- Baker

- Online retail

- Consulting… the options are endless!

My kids have been cleaning trash containers in our neighborhood every summer for the past 10+ years – guess what? That’s a small business!

Even if you are thinking of starting a business you can apply for a business card.

Opening business cards is advantageous because they don’t count towards your 5/24 status.

CARD DETAILS

The Chase Ink Unlimited and Cash cards are the easiest way to replenish your stash of Chase points!

Chase Ink Business Unlimited® Credit Card

75,000 point welcome bonus after $6,000 of spend in the first 3 months

NO ANNUAL FEE

Earns an easy 1.5% back on EVERYTHING

Chase Ink Business Cash® Credit Card

75,000 point welcome bonus after $6,000 of spend in the first 3 months

NO ANNUAL FEE

Earns 5% back on office supply stores and Internet, cable and phone services (on the first $25,000 spent in combined purchases each account anniversary year)

2% back on gas and restaurants (on the first $25,000 spent in combined purchases each account anniversary year)

1% back on everything else

The best card option for you will depend on the type of spending you will put on the card. For most people the Unlimited will result in more points since anything that falls in the “everything else” category will earn 1.5x points vs 1x point per $1 spent. After meeting the spend requirement on the Unlimited, you’ll have 84,000+ points which can be redeemed for over $1,500 in travel! NO FEES!

If you plan to utilize the 5x earnings rates at office supply stores then the Ink Cash card is also a great option.

NOTE: Both cards charge a foreign exchange fee so it’s best to only use these cards state side.

HOW TO USE THESE POINTS?

When you look at the welcome offer for these two Ink cards it will be listed as $750; however, it will actually post to your account as 75,000 points. If you’re not interested in transferring the points to travel partners you can redeem the points for cash. You can easily get 2x the value from your Chase points if you transfer those points to travel partners like Southwest, United, Hyatt, Air France, etc…

If you (or someone in your household) has one of the four cards below you will be able to move the points earned on the Unlimited and Cash Ink cards to one of these four cards and they will be transferrable to travel partners. Transferring your points to travel partners is where you will most likely get the most value from them.

- Chase Sapphire Preferred

- Chase Sapphire Reserve

- Chase Sapphire Reserve Business

- Chase Ink Business Preferred

The Chase Sapphire Preferred is the MOST recommended card to start with because of its low annual fee ($95) and fantastic travel protections. You can read more about that card HERE.

If you don’t have one of the four cards above now that doesn’t mean you can’t apply for the elevated offer on the Unlimited or Cash card. You can always apply for one of the four cards at a later date.

My favorite use of Chase points is to book FREE Hyatt stays, but you can just as easily use them to book flights.

You can read more about booking Hyatt stays HERE.

FILLING OUT THE APPLICATION

If you are applying for a well-established business then filling out the application will be pretty straightforward.

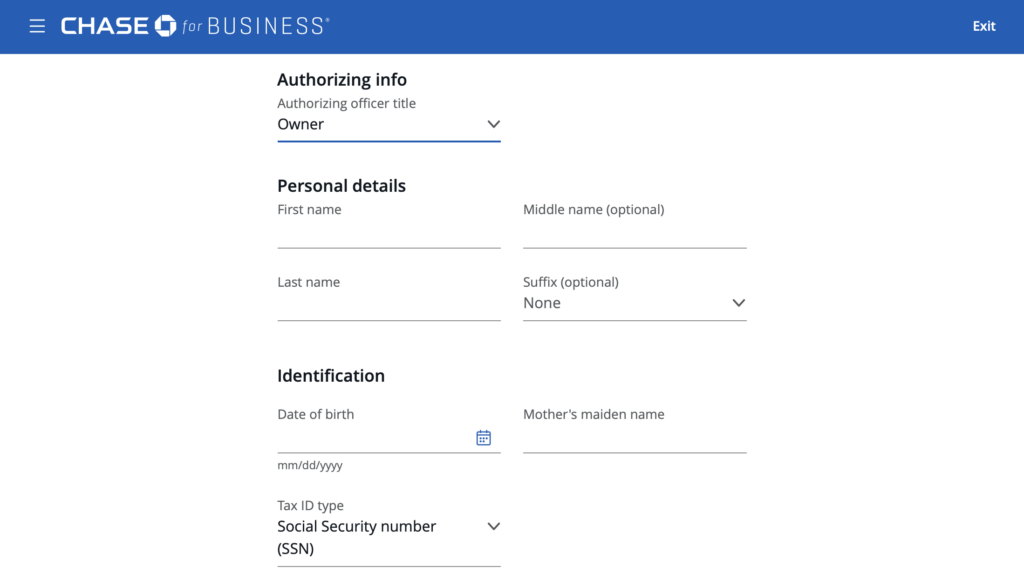

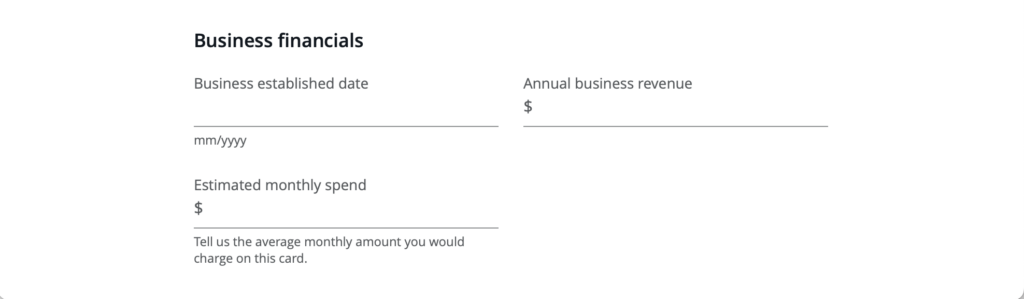

For anyone applying for a new business here’s an example of filing out the application assuming you don’t have any employees and you are operating as a sole proprietor by selling your old stuff on Facebook or any other used goods website or app.

Most of the application will be pretty straightforward, but let’s look at a few sections that may not be as self-explanatory:

Authorizing officer title: Select owner

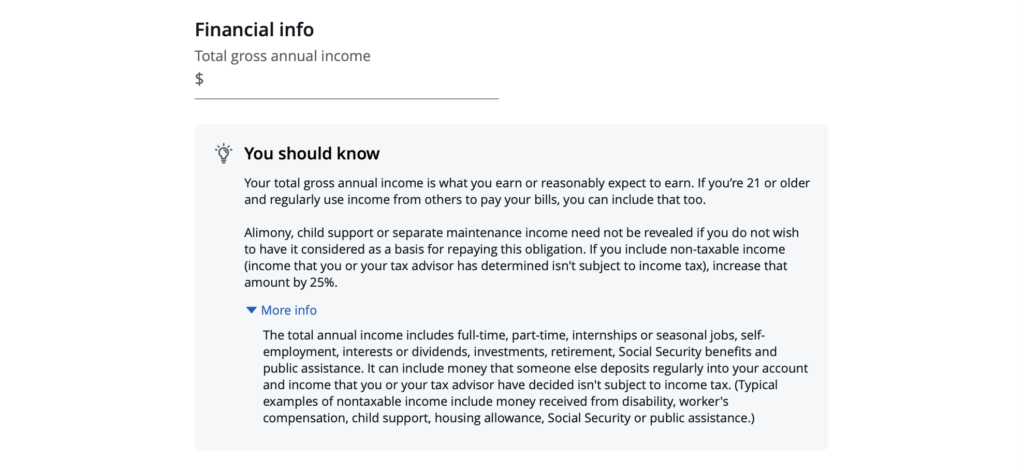

Total gross annual income: The income in this section can include ANY income in your household including income earned by a spouse and from businesses, investments, etc…

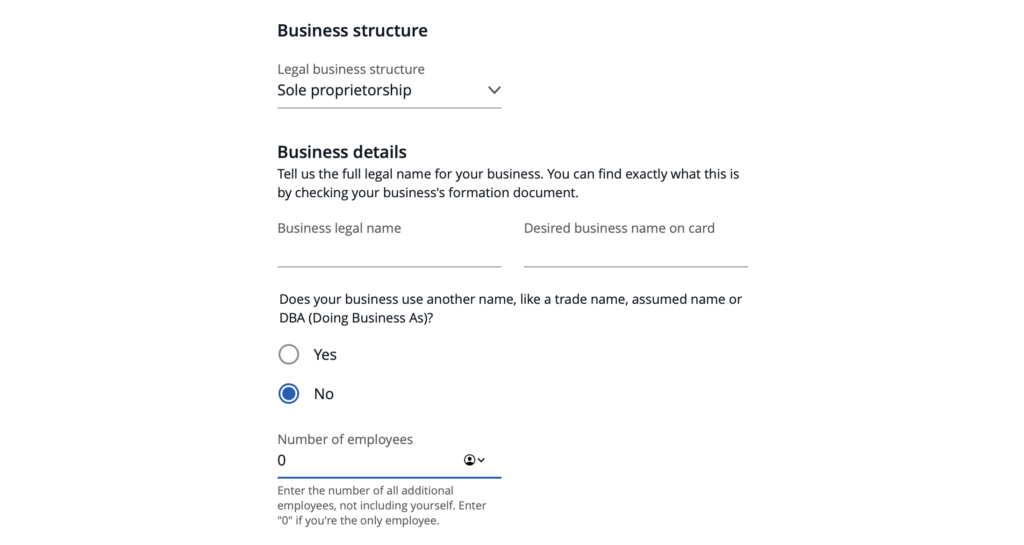

Legal business structure: Select sole proprietorship

Business legal name: If you don’t have a business name input your own name

Desired business name on card: Again, this can be your own name if you don’t have a business name

Number of employees: Enter “0” if you are the only employee

Business Tax ID: Select Social Security Number (SSN) if you don’t have an EIN

Business contact information: This can be your home address if you don’t have a separate business address

Annual business revenue: This can be based on prior monthly income and can include projected/expected future revenue from your business. People have been approved based on little to no income from the business.

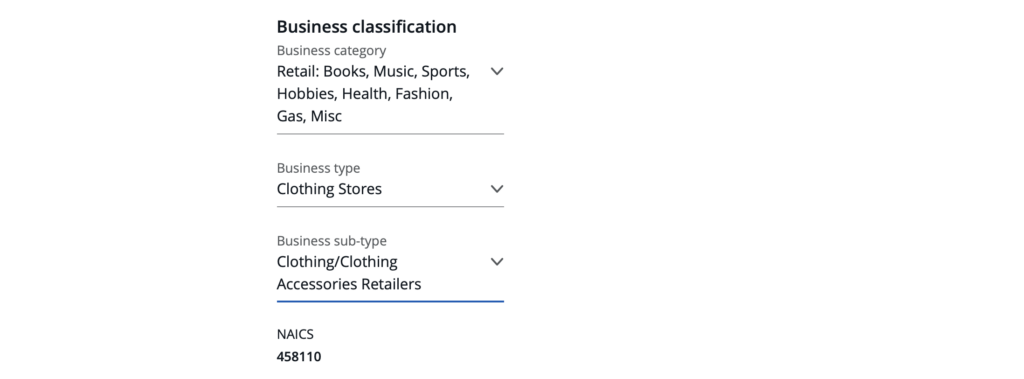

Business category/type/subtype: Pick whichever category most closely matches your business. If you’re selling your old clothes and household goods it could look something like this. There isn’t always a perfect match so just go with whatever fits best.

TIPS AND GUIDELINES

You are more likely to be approved for a Chase Ink Business card if you haven’t opened more than 5 personal cards in the last 24 months (aka you’re under 5/24). This is not a hard fast rule but something to be aware of. Applying for these cards will not add to your 5/24 status.

Recent data points also show a higher chance of approval if you don’t have more than three Chase business cards currently open. If you decide to close any of your older business cards to improve your chances, I recommend waiting at least 2 weeks (ideally 30 days) after closing the card before submitting a new application. Never close a card until you’ve had it at least a full year.

You can hold multiple Ink Business cards at the same time. If you have multiple businesses you can open the same card for each business. You can also hold the same card under your SSN and a second with an EIN. Personally, I don’t open the same version of the card if I already have one open for the same business EIN/SSN.

Chase generally will only approve one business card in a 30 day period so space out applications accordingly.

It’s not unusual for business cards to not be approved immediately so don’t panic if you receive a notification after submitting your application that they need time to consider your application. I do not recommend calling Chase while your application is pending, applications are frequently approved without calling.

If you are denied you can often get that reversed by calling Chase and asking them to reconsider. Sometimes the reason for a denial can be as simple as verifying your identity or correcting a mistake on an application. If you are denied based on having too much credit with Chase already, you can ask Chase to move credit from one of your existing cards to the new card.

FAQ: Can you put personal expenses on a business card?

Short answer is yes. From my experience as an accountant, I can attest that it’s not uncommon to put personal expenses on a business card. Some credit card applications will include a disclaimer that the card is for business expenses only – they are required to state that; however, you are not doing anything illegal if you choose to mix your personal and business expenses.

CONCLUSION

The Chase Ink Business Unlimited and the Chase Ink Business Cash cards are two of the easiest cards to build or replenish your stash of Chase points! 75,000 of our favorite credit card points and NO ANNUAL FEE makes these cards a no-brainer if you can earn the bonus without overspending.

______

Holly @onpointwithholly is part of an affiliate network and may receive commission when you support her efforts to continue to provide FREE content, resources and guidance. Send me a DM if you have any questions or would like help deciding the best credit card strategy for you!

leave a comment

Disclaimer: The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.