The Southwest Companion Pass is a favorite for many travelers and this post will explain how you can earn the Companion Pass for nearly two years! In addition to being able to bring a companion with you on EVERY flight you take, you’ll also have a HUGE stash of Southwest points that you can use to book those flights!

The value you get from the Companion Pass will depend on how often you use it and where you are flying.

What is the SWA Companion Pass?

Southwest Airlines offers an UNLIMITED companion pass to cardholders that earn 135,000 rapid rewards in one calendar year. This means you can add a companion to EVERY flight you take for just the taxes and fees (just $5.60 on domestic flights). The name of your companion can be changed three times in a calendar year and there are no blackout dates. You can even use the companion pass when you book your flight with points! The potential savings on this is UNLIMITED!

What Points Qualify?

- Cash Flights – all points earned on cash flights count

- Credit Card Welcome Bonuses – welcome offers on new credit cards count

- Credit Card Referral Bonuses – points earned by referring friends to a SWA card count

- Credit Card Spending – points earned on purchases put on your SWA cards

- Other Partners – this includes shopping and dining partners

- Rapid Rewards Bookings – hotels booked through the Southwest portal count

- Points Boost – if you hold a SWA card as of Jan 1, you’ll earn a 10,000 point “boost” within 30 days (these points are not redeemable for travel)

What Points Do Not Qualify?

- Transferred Points – points transferred from Chase do not count

- Purchased Points – points purchased from SWA do not count

How do you earn the Companion Pass?

You need to earn 135,000 rapid reward points in ONE calendar year to earn the companion pass. If you have a Southwest credit card open by January 1, 2025 you will automatically receive 10,000 qualifying rapid reward points by January 31, 2025. These 10,000 points are not redeemable for travel; however, they bring the total points needed for the Companion Pass down to 125,000.

The fastest way to earn the Companion Pass will be to earn the 125,000 points through credit card welcome offers.

You can earn the Companion Pass by opening one Southwest personal card and one SWA business card.

Or you can choose to open two business cards instead.

Timing is CRUCIAL!

Once you qualify for the Companion Pass you will have it for the remainder of the calendar year in which you earn it as well as the entire following year. So if you time it right you can hold the Companion Pass for nearly two years!

The timing of this is crucial! Do NOT complete the spend requirement on either card until after January 1, 2025!

I recommend waiting until AT LEAST October 15th to start working toward the companion pass.

Southwest Card Eligibility

The 5/24 Rule

You need to be under 5/24 to open a Chase card. The 5/24 Rule means you haven’t opened more than 5 cards in the past 24 months. You can read more about the 5/24 Rule here.

24 Month Rule

You can not have two personal Southwest cards and you can only earn ONE bonus on a personal Southwest card every 24 months.

➜ If you have a personal Southwest card already and it has been MORE THAN 24 months since you received the bonus you can close the card and apply for a new card after ~ 30 days

➜ If you have a personal Southwest card already and it has been LESS THAN 24 months since you received the bonus you can open two business cards instead or have your Player 2 get the companion pass instead

You can hold both versions of the Southwest business cards at the same time; however, you can not hold more than one of each business card. If you’ve earned a welcome bonus on a business card in the last 24 months you can not earn another bonus on that same business card.

Who Qualifies for a Business card?

Business credit cards are advantageous for many reasons and you don’t need an LLC or a large business to qualify for a business card. Any sort of side income counts, including something as simple as selling your old stuff on Facebook.

Check out this post for more information on applying for a business card.

Let’s Compare the Cards!

Personal Card Options

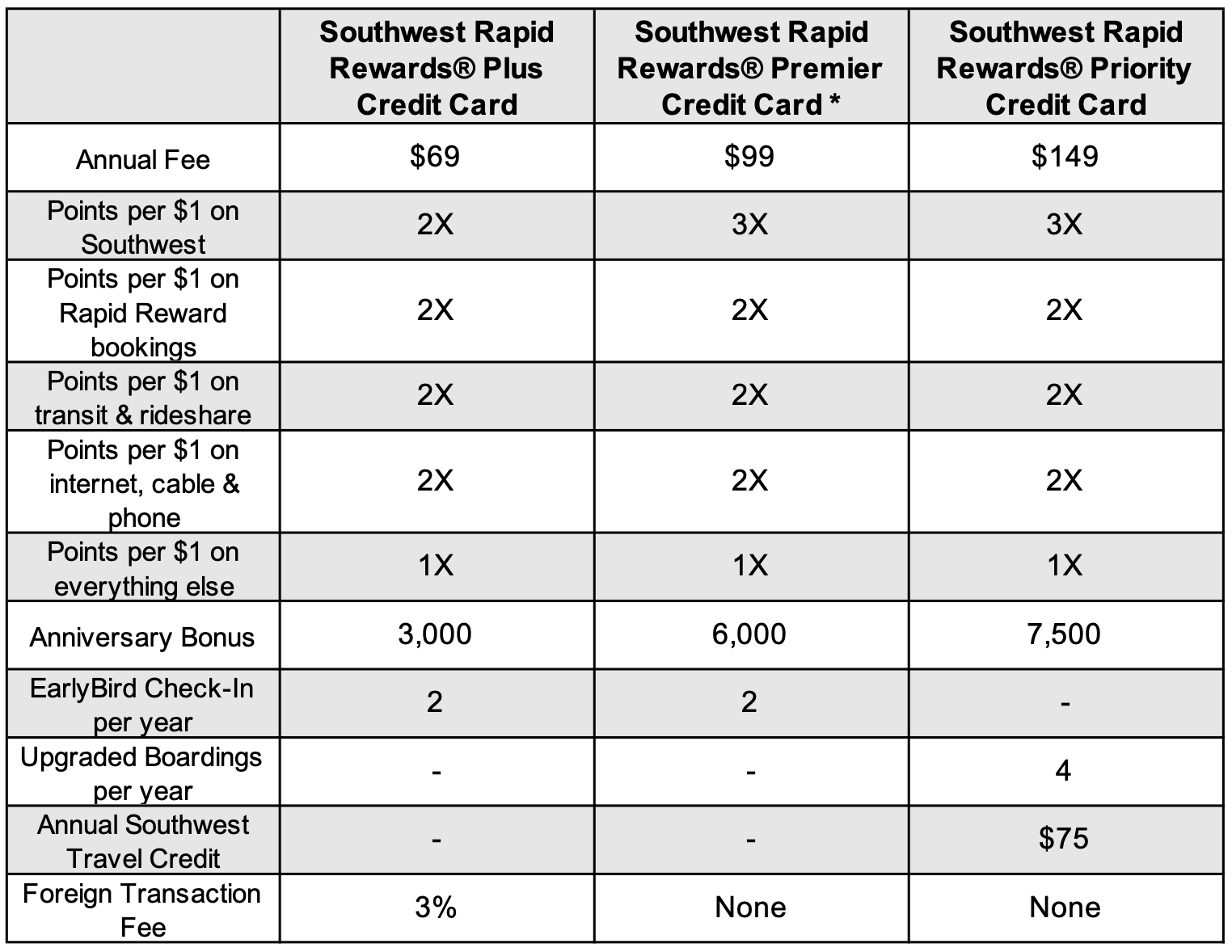

There are three different personal Southwest cards. The welcome offers on these cards change throughout the year; however, all three cards will typically offer the same welcome bonus and spend requirements. When deciding which card is the best for you consider the annual fee and card benefits.

* The information for the Southwest Rapid Rewards Premier Credit Card has been collected independently. The card details on this page have not been reviewed or provided by the card issuer.

I would choose either the Southwest Rapid Rewards® Plus Credit Card or the Southwest Rapid Rewards® Priority Credit Card.

Business Card Options

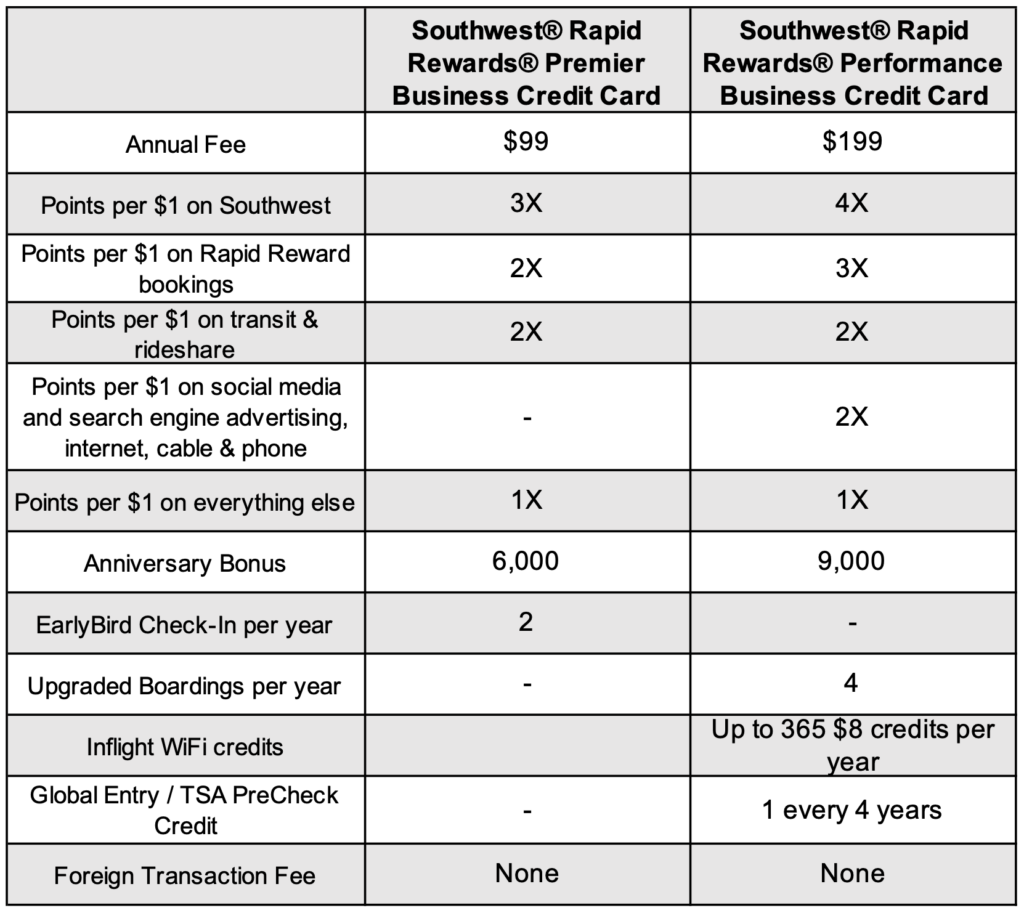

Southwest offers two different business cards. The welcome offers on the business cards can change throughout the year.

Let’s compare the two Southwest business cards:

Which Card Should I Open First?

The easiest way to earn the Southwest Companion Pass will be to open two Southwest credit cards. You can only have one personal Southwest card at a time so you will need to open a personal card and a business card. An alternative would be to open two business cards.

IN GENERAL, I recommend opening the Southwest® Rapid Rewards® Performance Business Credit Card first. Business cards do not take a 5/24 spot so you’ll be in a better position to qualify for the personal card later if you open the business card first. You will need to be under 5/24 to eligible for both the business and personal card.

The Southwest business cards also tend to have higher spend requirements so by opening the business card first, you’ll be able to get started on that earlier – REMEMBER, DO NOT complete the spend requirement until 2025!

If you are opening two business cards you will need to open one of each of the business card options.

It is recommended to wait at least 30 days between card applications.

NOTE:

When applying for a new credit card always use a referral link of a friend or family member. I appreciate your support when you use one of my links to apply for a new credit card as it allows me to continue to provide FREE content and resources to help you travel more for less!

** NOTE: Please send me a DM if you’re ready to apply for a new card and I’ll get that link sent to you! Thank you for supporting my small business!

Reminder!

Did I mention that the timing of earning these welcome bonuses is CRITICAL if you want to earn the Companion Pass for nearly 2 years? In case you missed it… DO NOT complete the minimum spend on either card until after January 1, 2025.

leave a comment

Disclaimer: The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.